2020 has been a most unusual and challenging year. We are looking forward to a brighter, more rewarding, Covid-free time ahead. We are honored and grateful for the confidence you continue to place in us as we aspire to be your trusted tax advisor.

Firm Policy Note: We will be sending out engagement letters and tax organizers in a couple of weeks. Please review, sign, and return your engagement letter. Our firm policy does not allow us to complete your tax return until we have the signed engagement letter.

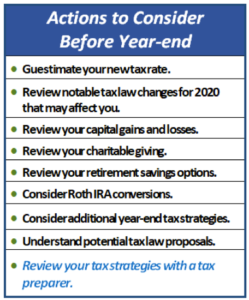

Planning can help minimize your tax liability while reducing tax surprises. This letter is long and not every section will apply to everyone. Our goal is that the strategies and ideas will lead to discussion and implementation which in turn will save you money by lowering your taxes. We are available to answer any of your questions and help utilize any tax saving strategies.

New Tax Legislation

Setting Every Community up for Retirement Enhancement Act (SECURE): On December 20, 2019, the President signed the Consolidated Appropriations Act of 2020, which included the SECURE Act. The primary focus of this Act was to make changes to tax rules on retirement matters. All changes begin with the 2020 tax year, unless otherwise noted.

- Those with earned income past age 70½ can continue to make IRA (“individual retirement account”) contributions. Formerly, this was

- For those who turn age 70½ after 2019, RMDs (“required minimum distributions”) are not required to begin until the year they attain age 72. Note the CARES Act, discussed next, which made another change here for 2020

- IRAs or retirement plans of decedents must now be distributed to the beneficiary within 10 years. No longer can the account be “stretched” for decades over the life expectancy of a much younger beneficiary. Exceptions include spouses, disabled beneficiaries, chronically ill beneficiaries, those not more than ten years younger, and minor children (until they reach age 18, in most states).

- Up to $5,000 can be withdrawn from an IRA or retirement plan for childbirth or adoption expenses. These distributions are exempt from the 10% penalty for premature distributions but remain subject to income

- Up to $10,000 of student loans can be paid with 529 plan

Some other changes in the Consolidated Act include the following extensions through 2020:

- Deduction for qualified higher education expenses up to $4,000, for single filers with AGI up to $65,000 (married-filing-jointly $130,000). Deduction becomes $2,000 for AGI of $65,000 to $80,000 single ($130,000 to $160,000 married jointly). There is no deduction past these

- Deduction of mortgage insurance premiums as residence

- Exclusion from income of up to $2 million of debt forgiveness on a principal

The Coronavirus Aid, Relief, and Economic Security Act (Cares): On March 27, 2020, the President signed the CARES Act. This Act was intended to provide relief to individuals and businesses from the economic slowdown from the COVID-19 pandemic.

All changes are effective for the 2020 tax year unless otherwise noted.

- Taxpayers received economic stimulus payments of $1,200 ($2,400 for couples filing jointly), plus $500 more for each child under the age of 17. The stimulus payments are not taxable. With your 2020 tax organizer, be sure to let us know how much you received. If you are entitled to more based on 2020 income, then a credit will be reflected on your 2020 income tax

- The requirement to take a RMD from your IRA or retirement plan account was waived for

- For 2020 only, those who claim the standard deduction are allowed an additional deduction for up to $300 of cash charitable contributions.

- Special tax rules apply to 2020 retirement distributions of up to $100,000 if qualify as Coronavirus-related.

- Qualifying distributions are those made to an individual:

- Diagnosed with COVID-19;

- Whose spouse or dependent is diagnosed with COVID-19, or

- Who experiences adverse financial consequences as a result of: being quarantined; being furloughed, laid off, or having work hours reduced due to COVID-19; being unable to work due to lack of child care due to COVID-19; closing or reduced hours of a business owned or operated by the individual; or other factors determined by the IRS (no guidance has been released yet on what these factors are).

- The special tax rules for these distributions include:

- No 10% premature distribution

- Income tax on the distribution is spread equally over the 2020, 2021, and 2022 years, unless the taxpayer elects to report it all in

- The distribution can be returned and rolled back into the retirement account at any time in the 3-year window beginning with the distribution date.

- Net operating loss (NOL) carrybacks return, but only for 2018, 2019, and 2020. Losses in these years can be carried back for five

- Self-employed individuals can defer payment of 50% of the 12.4% FICA part of the self-employment tax. If deferred, half is due December 31, 2021 and the other half is due December 31, 2022. This is the FICA related to self-employed income earned March 27, 2020 through December 31, 2020.

- The Act included a long-sought retroactive fix to the depreciation of Qualified Improvement Property. If your tax return includes non-residential rentals, additional depreciation may be available.

- Qualifying distributions are those made to an individual:

Itemized Deductions

Evaluate the use of itemized deductions vs standard deduction: For 2020, the standard deduction amounts will increase to $12,400 for individuals and married couples filing separately, $18,650 for heads of household, and $24,800 for married couples filing jointly and surviving spouses.

As a reminder, in 2018, the Tax Cuts and Jobs Act roughly doubled the standard deduction. It’s reported that this helped decrease tax payments for many of those who typically claim this standard deduction. Although personal exemption deductions are no longer available, the larger standard deduction, combined with lower tax rates and an increased child tax credit, could result in less tax. We will run the numbers to assess the impact on your situation.

The TCJA eliminates or limits many of the previous laws concerning itemized deductions. An example is the state and local tax deduction (SALT), which is capped at $10,000 per year, or $5,000 for a married taxpayer filing separately.

Medical Expenses: For 2020, your medical expenses are only deductible as an itemized deduction to the extent the expenses exceed 7.5% of your adjusted gross income (AGI). The IRS on www.IRS.gov provides a long list of expenses that qualify as “medical expenses”. It may be advantageous to keep track of your medical expenses.

Mortgage Interest Deduction: If you sold your principal residence during the year and acquired a new principal residence, the deduction for any interest on your acquisition indebtedness (i.e., mortgage) could be limited. The TCJA limits the interest deduction on mortgages of more than $750,000 obtained after December 14, 2017. The deduction is limited to the portion of the interest allocable to $750,000 ($375,000 for married taxpayers filing separately). For mortgages acquired before December 15, 2017, the limitation is the same as it was under prior law: $1,000,000 ($500,000 for married taxpayers filing separately).

You can potentially deduct interest paid on home equity indebtedness, but only if you used the debt to buy, build, or substantially improve your home. Thus, for example, interest on a home equity loan used to build an addition to your existing home is typically deductible, while interest on the same loan used to pay personal living expenses, such as credit card debts, is not.

Charitable Contribution Deductions: The contribution must be made by December 31st of that year. A check mailed with a December 31st postmark is acceptable. A credit card charge is deductible when charged, not when the credit card bill is paid. The organization cannot “hold the books open” for a few days after the end of the year and credit those contributions to the year just ended.

- Be sure to keep a receipt of all contributions of $250 or more. For contributions over $250, you must have a written statement from the charity that no goods or services were received prior to filing your tax return.

- There are limitations on the amount of charitable contributions that you may deduct. For individuals, the limit was 60% of AGI, or 30% of AGI if the donation is capital gain property.

- For 2020 only, the CARES Act suspended the 60% limit for cash contributions and the limit is 100% of AGI. Any excess may be carried over for up to five years in the future.

- Contributions may also be limited if the qualified organization is not considered by the IRS to be a 60% limit organization. This includes contributions to veterans’ organizations, fraternal societies, nonprofit cemeteries, and certain private non-operating foundations.

- Contributions made to these organizations are subject to a limit of 30% of AGI, or 20% of AGI if the donation is capital gain.

- Individuals age 70½ can direct IRA withdrawals up to $100,000 to charity

- Gifts of appreciated stock is an even better idea since you get a full deduction without reporting the appreciation as income.

With the expanded standard deduction in place, remember that you must be able to itemize for charitable contributions to have a tax benefit.

This overview provides some strategies for deriving the maximum tax benefit from charitable contributions. Before making significant contributions, please consult with us to assure that you are receiving the maximum benefit.

Consider All of Your Retirement Savings Options for 2020: If you have earned income or you are working, you should consider contributing to your employer’s retirement plan. This is an ideal time to make sure you maximize your retirement plans for 2020 and start thinking about your strategy for 2021. For many investors, retirement contributions represent one of the smarter tax moves that they can make. Here are some retirement plan strategies we would like to highlight.

- 401(k) contribution limits increased.The elective deferral (contribution) limit for employees under the age of 50 who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is $19,500, up from $19,000. The catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan increases also to an additional $6,500 ($26,000 total). As a reminder, these contributions must be made in 2020.

- IRA contribution limits unchanged. The limit on annual contributions to an Individual Retirement Account (IRA) which was increased in 2019, remains at $6,000 for 2020. The additional catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000 (for a total of $7,000). IRA contributions for 2020 can be made all the way up to the April 15, 2021 filing deadline.

- Increased Roth IRA income cutoffs. The MAGI phase-out range for taxpayers making contributions to a Roth IRA is $196,000 – $206,000 for married couples filing jointly in 2020. For singles and heads of household, the income phase-out range is $124,000 – $139,000. For a married individual filing a separate return, the phase-out range remains at $0 to $10,000. Please keep in mind, if your earned income is less than your eligible contribution amount, your maximum contribution amount equals your earned income.

- Simplified Employee Pension (SEP) Plan. Self-employed individuals can have a SEP and contribute as much as 20% of their net earnings from self-employment, not including contributions to themselves. The contribution limit for 2020 is $57,000. The self-employed individual can set up a SEP as late as the due date of their 2020 income tax return, including extensions.

- Be careful of the IRA one rollover rule. Investors are limited to only one rollover from all their IRAs to another in any 12-month period. A second IRA-to-IRA rollover in a single year could result in income tax becoming due on the rollover, a 10% early withdrawal penalty, and a 6% per year excess contributions tax as long as that rollover remains in the IRA. Individuals can only make one IRA rollover during any 1-year period, but there is no limit on trustee-to-trustee transfers. Multiple trustee-to-trustee transfers between IRAs and conversions from traditional IRAs to Roth IRAs are allowed in the same year.

Make the most of long-term capital gains: Short term capital gains are taxed at your ordinary income tax rate. While long term capital gains rates are 0, 15, or 20% plus special rates of 25% for certain real estate and 28% for collectibles. Capital assets held longer than one year are long term and are taxed at favorable tax rates.

|

Long-Term Capital Gains Rate Brackets |

||||

|

|

Single |

Joint |

Head of Household |

Trusts |

|

0% bracket |

$0 – $40,000 |

$0 – $80,000 |

$0 – $53,600 |

$0 – $2,650 |

|

15% bracket begins |

$40,001 |

$80,001 |

$53,601 |

$2,651 |

|

20% bracket begins |

$441,451 |

$496,601 |

$469,051 |

$13,151 |

- Remember that you can use capital losses, including worthless securities to offset capital gains

- If capital losses exceed capital gains during the year, you can offset ordinary income by up to $3,000 of your losses. You can carry forward the excess capital loss to the next tax year.

- Do not violate the “wash sale” rules by buying an asset nearly identical to the one you sold at a loss within 30 days before or after the sale. Otherwise the wash sale rule will prevent you from claiming the loss immediately.

Timing income and expenses can be important reduction strategy: The new tax rates from the TCJA are about the same in 2019 versus 2020 and 2021, with modest adjustments for inflation assuming the tax structure does not change for 2021.

- Deferring income and accelerating deductions benefits you primarily by delaying the time when the tax is due. It does not significantly change the amount of tax unless your taxable income is dramatically different in one of the years.

- In that case, try to focus the deductions on the higher income year(s), and to trigger the income in the lower income year(s). Defer income into next year and accelerate deductions into the year you expect to be in a lower tax bracket through 2025 under current law.

- If you expect the reverse, consider accelerating the income into 2020 and deferring deductions into the

Additional Year-End Tax Strategies and Ideas:

Education Planning. The student loan interest deduction, education credits, exclusion for savings bond interest, tuition waivers for graduate students, and the educational assistance fringe benefit are all still available in 2020. Also, starting in 2020, 529 plan funds can now be used to pay for fees, books, supplies and equipment for certain apprenticeship programs. In addition, up to $10,000 in total (not annually) can now be withdrawn from 529 plans to pay off student loans.

The 2020 lifetime learning credit, which allows you to claim 20% of your out-of-pocket costs for tuition, fees, and books, up to $10,000, for a total of $2,000. The credit phases out for couple at $118,000 to $138,000. The AGI range for singles is $59,000 to $69,000.

The 2020 lifetime learning credit, which allows you to claim 20% of your out-of-pocket costs for tuition, fees, and books, up to $10,000, for a total of $2,000. The credit phases out for couple at $118,000 to $138,000. The AGI range for singles is $59,000 to $69,000.

Make use of the annual gift tax exclusion. You may gift up to $15,000 tax-free to each donee in 2020. These “annual exclusion gifts” do not reduce your $11,580,000 lifetime gift tax exemption. This annual exclusion gift is doubled to $30,000 per donee for gifts made by married couples of jointly held property or when one spouse consents to “gift-splitting” for gifts made by the other spouse.

Casualty and Theft Losses. If you incurred a casualty loss in a presidentially declared disaster area in 2020, it may be deductible. Any other casualty loss, along with all theft losses, are not deductible.

Alimony deductions. Under prior law, alimony and separate maintenance payments were deductible by the payor and includible in income by the payee. For divorce and separation instruments executed or modified after December 31, 2018, alimony and separate maintenance payments are not deductible by the payor-spouse, nor includible in the income of the payee-spouse.

Section 199A Passthrough Tax Break. Enacted as part of TCJA, the Section 199A tax break allows a 20 percent deduction for qualified business income from sole proprietorships, S corporations, partnerships, rental real estate, and LLCs taxed as partnerships. If you qualify for the deduction, it is taken on your individual tax returns as a reduction to taxable income.

Please call our office today at 281-406-8984 so we can set up an appointment for a year-end review. We can estimate your tax liability for the year and determine whether any estimated tax payments may be due before year end. Planning can help you minimize your tax bill and position you for greater success.

Sincerely,

Tammy Mihail, CPA

Tamara L. Mihail CPA, LLC

These general guidelines are based on information from the Internal Revenue Service and other resources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. These are only guidelines. The firm, its employees, and staff make no representation guarantee or warranty, express or implied, that this compilation is error-free or that the use of this letter will prevent differences of opinion or disputes, and assumes no liability whatsoever in connection with its use. Please note that statements made in this letter may be subject to change depending on any revisions to the tax code or any additional changes in government policy.